This article is for all of you who are on the trenches of airdrop farming & want to speculate your life’s savings (DON’T) into this meme coin mania. If you follow this article and manage your emotions right, I don’t think you can fail in any scenario whatever this crypto griptoe cycle throws at you. (just start small and don’t be greedy)

First things first.

Griptoe =/= Crypto.

Only coins that have real value are BTC (gold), ETH (Compute, though I am still not sold on the idea that we need smart contracts or AMM but….), XMR (anon & decentralization-in-built, its not for growth or asset protection - it’s just cash) and maybe LINK (interoperability). Everything else will most likely fade away so aspire to not pay the bag holder tax on those.

Your only goal is to get alpha meme coins at ANY entry and near peek exit.

You will only hold BTC & ETH or some stable coin like USDT but I am still not sold on dollar pegging (crying in terra luna) or if the implementation is even pegging the dollar in-practice (DM if you got a good argument for this) though it has percieved stability so that’s nice ¯\_(ツ)_/¯.

You want to go this way:

BTC → ETH (Main Chain) → alt chains → SHITTT coin .

Sell it when you had enough (10-100x)

Get back to ETH ASAP.

Keep MOST of your portfolio in cold-multisig BTC wallet. (Foundation Devices’ passport is nice, though can’t beat coldcard (this is not open source ¯\_(ツ)_/¯), seed signer & mnemonic phrase (engraved on gold) combo in spectre wallet. Should run your own node if can. safe.global for eth assets (should sell on maturity)

Why this strategy works?

Marketing teams in crypto have realized that the best way to gain traction is airdrops, task completion (twitter & discord) & presales. So they are pouring the money there.

Who benefits from this?

Whales and degen traders who have spent a few cycles in crypto and anyone who is money laundering and want to use the untaxxed dollars somewhere.

And you <index finger pointing emoji>

Why VC’s pouring money into crypto?

<A lesson on Hedge fund vs Private Equity vs Venture Capital>

They bet on 10 very risky companies to get 1000x on 1 (and -100% from others), the original degens.

Crypto is the new gold rush for High Net People. (SEO is the gold rush for plebs)

Also Money laundering works pretty well in crypto, so untaxxed dollars are also pushing it.

Your only goal is to buy coins with a good narrative, that have solid technicals, what whales have in their bags and at a-okay price and sell it way before the plebs get in.

learn Technical Analysis

Technical Analysis Series | CryptoCred (Most important videos: Risk Management, RSI, Ichimoku Cloud & Trendliness)

Read all his blog posts, scrape ppt’s and descriptions.

Airdrop farming

100 PVA google accounts (& 100 bluestack instances for gameFi etc)

Do the airdrop tasks

150 residential proxies in Antidetect browser (ghost, octo etc).

New Metamask wallet in each profile.

Get Shit coins.

Pool all tokens into a safe wallet (in separate browser (Mullvad?))

Sell tokens for Eth at the price you are comfortable with.

Send some to cold btc.

P.S. if they want you to download something on your system, better do in a VM than be sorry after. (though I haven’t seen any legit coins doing that before)

Presales and cycles

TODO

Study $TREN

When to sell?

When the Coinbase app is top 10-50 on app/play store worldwide/US. (Plebs got in)

When marketing is at ath. (Inflated books)

Threads

Most important lessons to learn about crypto investing | SecretsOfCrypto

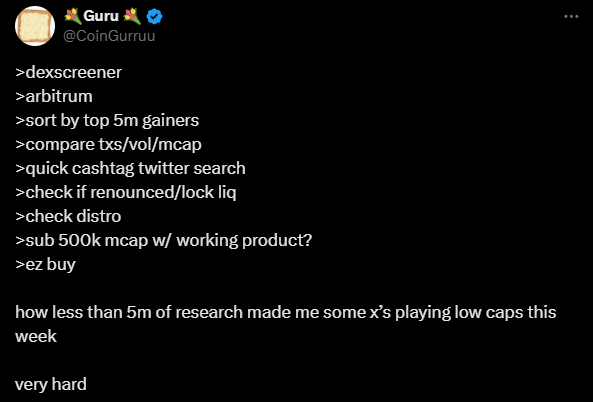

Finding new launches so you aren't buying late/being exit liquidity | Coin Guruu

Thread on finding low cap gems and not buying scams | CoinGurruu

on-chain Security or how not to get rugged chasing generational Wealth.

“““

I use https://ave.ai/ to make sure that the coin is safe to buy. Paste in the contract address and on the top right click Security Check

Not every “Risk Check” has to be met but the more the better

Some important risks to check for:

Doesn’t look like a honeypot (Means you can buy, but can’t sell)

Contact is open source (Means the contract is verified, and you can read it on Etherscan)

No blacklist (Means they aren’t selectively blocking wallets from selling)

Can not Mint (Means they can’t keep making new tokens)

LP is locked (Means they can’t pull the Liquidity Pool, AKA the conventional “Rug Pull”)

On the right make sure that there is an even distribution of wallet holdings:

No wallet with over 5% of the tokens ✔️

Top holder is UNISWAPV2 which is the Liquidity Pool ✔️

You can also see the percentage of LP locked is 96.96% ✔️

The best thing about this strategy is that it’s totally personal, if you find the right wallets you have an edge no one else does.”””

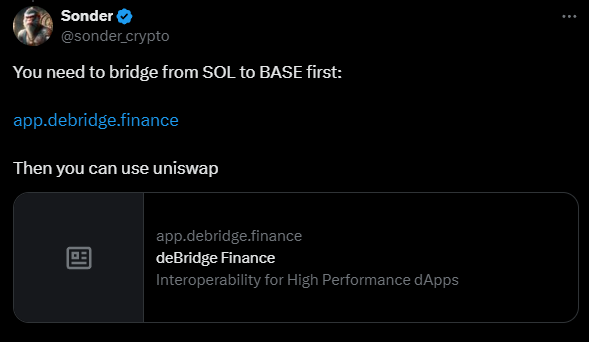

Copy pasted from this guide by sonder.

Stay Safe,

Truth, Wisdom & Tech Savviness.